Condo's Buyer Guide

This Guide is for buyer to understand more on:

- What is the timeline for Building Under Construction (BUC) Condo

- What is Buyer Stamp Duty (BSD) and Additional Buyer Stamp Duty (ABSD)

- CPF Minimun Sum

- Loan to Value (LTV)

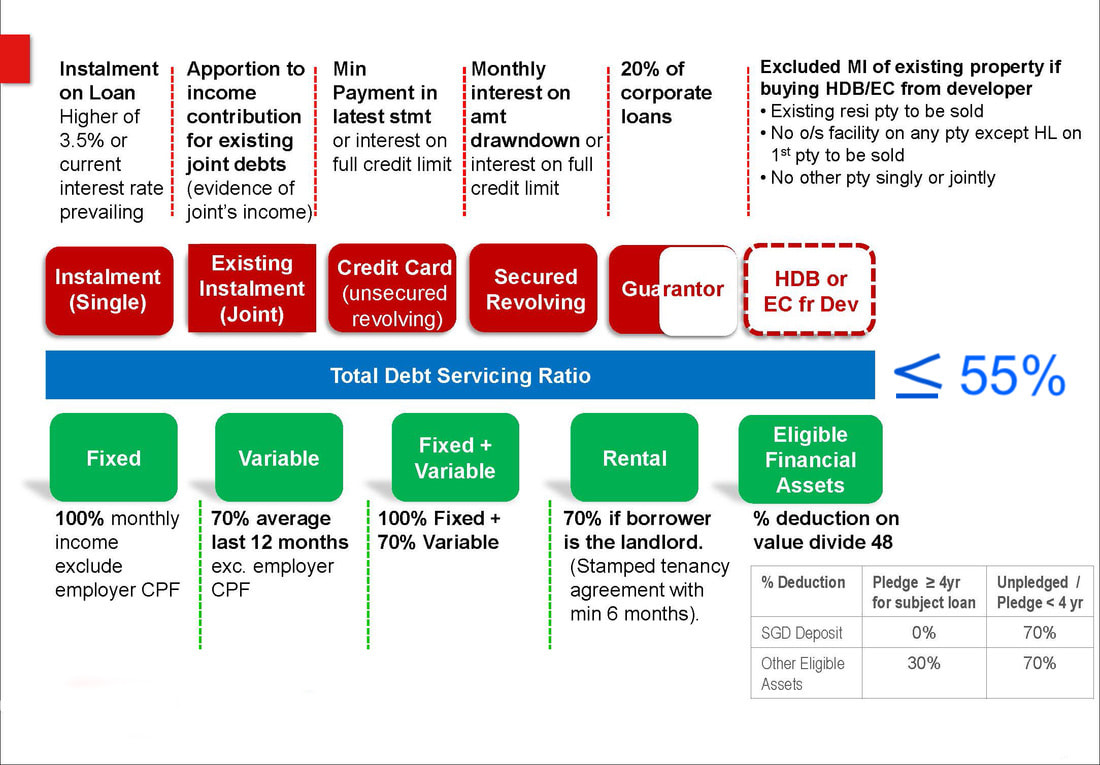

- Total Debt Servicing Ratio (TDSR)

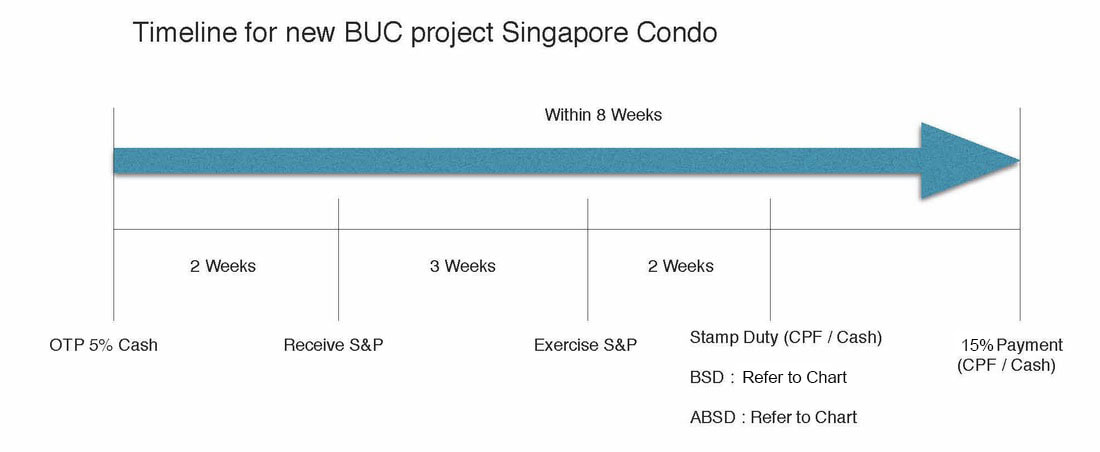

Timeline for New Condo (BUC)

First 20% Downpayment

If buyer is able to secure a bank loan of 75% (Max Loan), the downpayment of the BUC Condo is as such. |

Total 100% |

Mode of Payment |

Upon obtaining Option to Purchase |

5% |

Cash Only |

Upon Exercising of Sales and Purchase agreement |

15% |

Cash or CPF |

Buyer stamp duty (BSD). - Refer to BSD Chart Below |

- |

Cash or CPF |

Additional Buyer Stamp duty (ABSD) (Inform lawyer beforehand so as to reimburse through CPF provided that you had set aside Minimal Sum) - Refer to ABSD Chart Below |

- |

Cash Only |

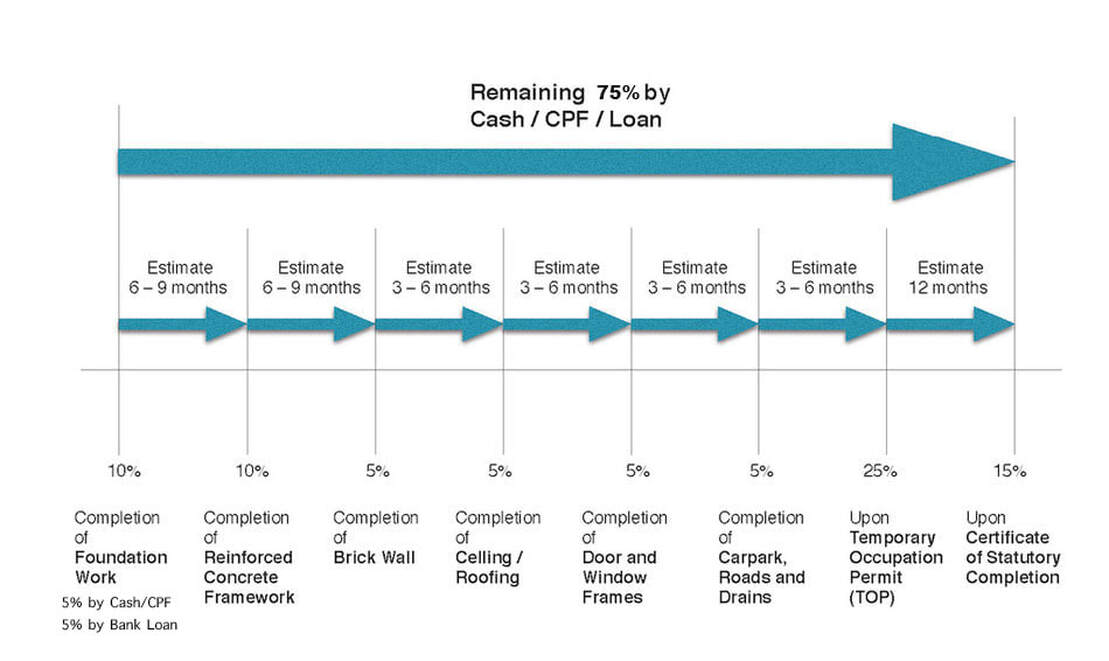

Completion of Foundation Work (Total 10%, but payment will be split into 5% Cash or CPF and 5% under bank loan) |

5% 5% |

Cash or CPF Bank Loan |

When buyer secure bank loan for the rest of the payment |

70% |

Bank Loan |

Progressive Payment for the remaining 75%

Buyer Stamp Duty (BSD) on or after 15 Feb 2023

Property Value |

BSD Rates for Residential Properties |

BSD Rates for Non - Residential Properties |

First $180,000 |

1% |

1% |

Next $180,000 |

2% |

2% |

Next $640,000 |

3% |

3% |

Next $500,000 |

4% |

4% |

Next $1,500,000 |

5% |

5% |

Amount Exceeding $3,000,000 |

6% |

5% is the maximum for Non - Residential |

For a property of price or market value from $360,000, and below $1,000,000, the buyer stamp duty can be calculated using the formula below:

BSD = (3 % x Purchase Price) - $5, 400

BSD = (3 % x Purchase Price) - $5, 400

For a property of price or market value from $1,000,001 and below $1,500,000, the buyer stamp duty can be calculated using the formula below:

BSD = (4 % x Purchase Price) - $15, 400

BSD = (4 % x Purchase Price) - $15, 400

For a property of price or market value from $1,500,001 and below $3,000,000, the buyer stamp duty can be calculated using the formula below:

BSD = (5 % x Purchase Price) - $30, 400

BSD = (5 % x Purchase Price) - $30, 400

For a property of price or market value from $3,000,001 and above, the buyer stamp duty can be calculated using the formula below:

BSD = (6 % x Purchase Price) - $60, 400

BSD = (6 % x Purchase Price) - $60, 400

Additional Buyer Stamp Duty (ABSD)

On or After 27 April 2023

Citizenship |

ABSD Rates on 1st Residential Properties |

ABSD Rates on 2nd Residential Properties |

ABSD Rates on 3rd and subsequent Residential Properties |

Singapore Citizen |

No Changes: 0% |

Before: 17% Revised: 20% |

Before: 25% Revised: 30% |

Permanent Residents (PR) |

Before: 5% No Changes: 5% |

Before: 25% Revised: 30% |

Before: 30% Revised: 35% |

Foreigners buying any residential property |

Before: 30% Revised: 60% |

Before: 30% Revised: 60% |

Before: 30% Revised: 60% |

Entities, Trustees buying any residential property |

Before: 35% Revised: 65% |

Before: 35% Revised: 65% |

Before: 35% Revised: 65% |

Under the respective Free Trade Agreements (FTAs), Nationals or Permanent Residents of the following countries will be accorded the same Stamp Duty treatment as Singapore Citizens:

- Nationals and Permanent Residents of Iceland, Liechtenstein, Norway or Switzerland

- Nationals of the United States of America

Schedule of Payments for BUC

Progress of Payment |

Percentage of Payment |

Upon obtaining Option to Purchase |

5% |

Upon Exercising of Sales and Purchase agreement |

15% |

Completion of Foundation Work |

10% |

Completion of Reinforced Concrete Work |

10% |

Completion of Brick Wall |

5% |

Completion of Celling / Roofing |

5% |

Completion of Door Sub-Frames / Door Frames, Window Frames, Electrical Wiring (without fittings), Internal Plastering, and Plumbing |

5% |

Completion of Car Parks, Roads, and Drains serving the housing project |

5% |

Building; roads, drainage, and sewage works; connection of water; and electricity and gas supplies (At this stage, the Temporary Occupation Permit (TOP) is typically released, which means you can pick up your keys and move in |

25% |

Final Payment Date and/or Completion (might be staggered further depending on when the Certificate of Statutory Completion is issued) |

15% |

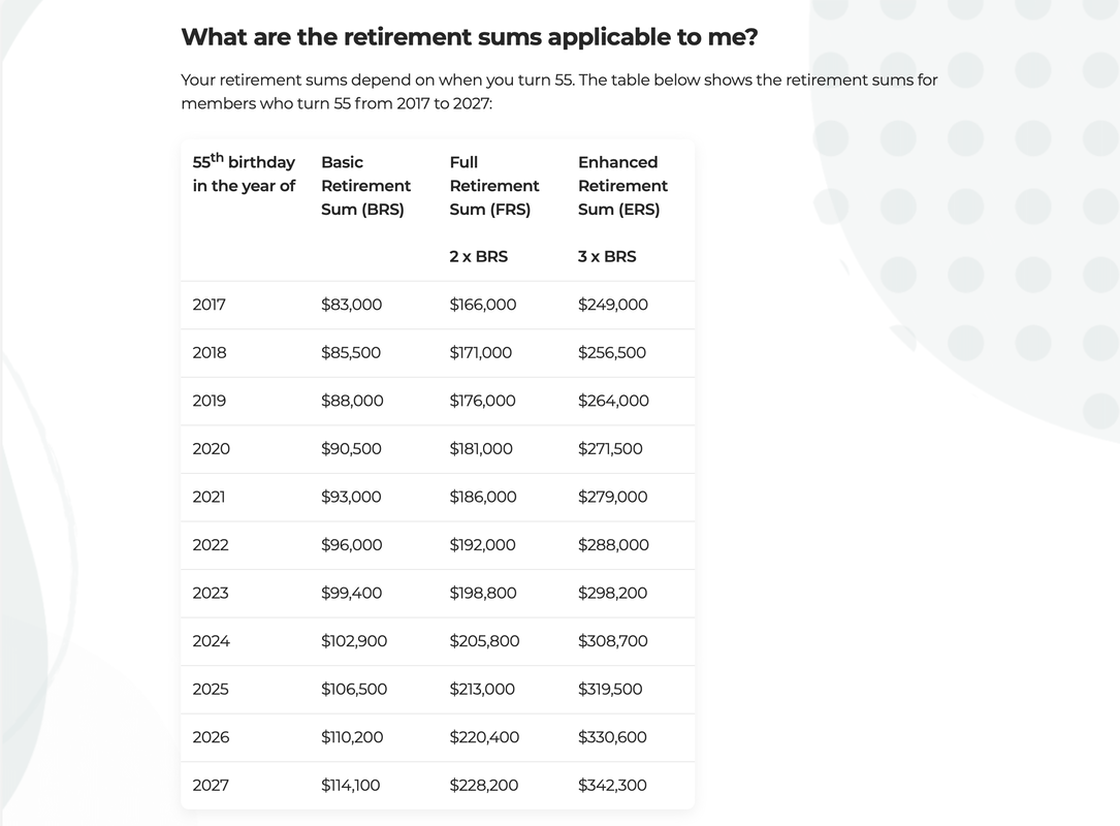

CPF Minimum Sum for 2nd property onwards

Before turning 55, each buyer have to set aside Basic Retirement sum (BRS) according to the chart yearly in order to use your CPF Ordinary Account (OA) to make downpayment for the 20%.

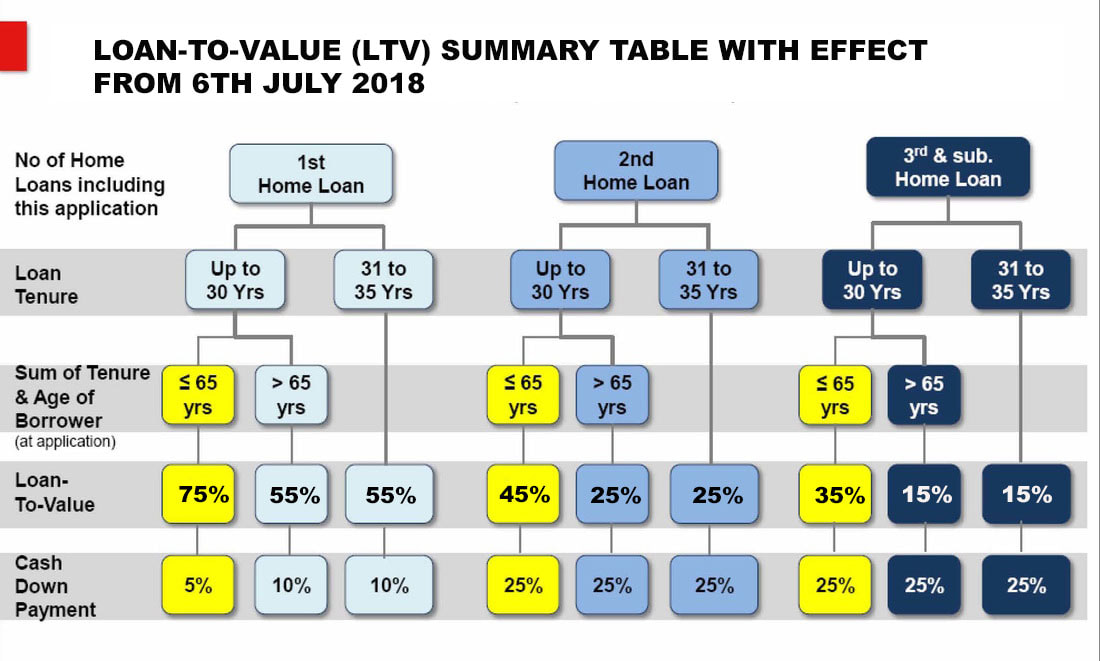

Loan To Value (LTV)

Depending on currently what is the home loan you have. If you had fully paid for your first property and you wish to purchase for a 2nd property and you want to get a loan, it will be consider as 1st home loan.

NOTE: LTV for non-individual borrowers (e.g. Company) is 15% only

NOTE: LTV for non-individual borrowers (e.g. Company) is 15% only